In an increasingly globalized world, money transfers have become a common necessity. When sending money abroad or making business deals, know SWIFT and BIC codes. They are crucial. This article breaks down what these codes are, how to find them, and why they matter.

Imagine sending money to a friend in another country. You want to ensure the funds reach the right bank. This is where SWIFT and BIC codes come into play. They are the backbone of international transactions. They ensure your money gets to the right place, without a hitch.

What Are SWIFT and BIC Codes?

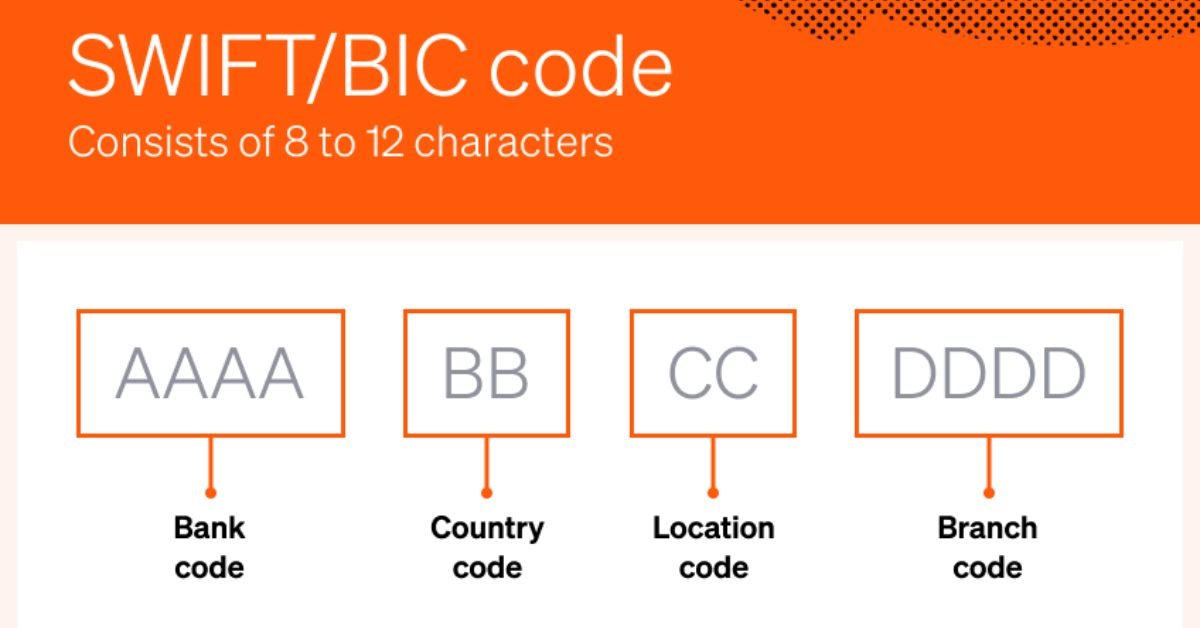

SWIFT (Society for Worldwide Interbank Financial Telecommunication) and BIC (Bank Identifier Code) codes identify banks and financial institutions worldwide. These codes ensure that money transfers are processed accurately and securely.

How Do I Find My SWIFT Code/BIC Code?

Finding your code is relatively simple. Here are a few ways to do it:

- Bank Statements: Your bank statements often include the code.

- Online Banking: Log into your online banking account and check the details section.

- Bank’s Website: Visit your bank’s official website. They usually have a dedicated section for SWIFT codes.

- Customer Service: Call your bank’s customer service for assistance.

Quick Tip

Always double-check the code you find. A small error can lead to significant issues in your transaction.

Is a SWIFT Code the Same as a BIC Code?

Yes, a SWIFT code and a BIC code refer to the same thing. Both terms are used interchangeably to identify financial institutions during international transactions. The main difference is that “SWIFT” is the organization that provides the codes. “BIC” is the actual code used to identify the banks.

Importance of Accurate SWIFT/BIC Codes

Accuracy is vital when using codes. Here’s why:

- Avoid Delays: Incorrect codes can lead to delays in processing your funds.

- Prevent Loss of Funds: Mistakes can result in lost money or funds being sent to the wrong account.

- Ensure Compliance: Financial regulations require accurate information for international transfers.

Consequences of Errors

A wrong code can complicate your transaction. Always verify the code before sending money.

Security Measures for SWIFT/BIC Codes

Security is paramount when it comes to financial transactions. Here are some measures to consider:

- Encryption: It uses advanced encryption to protect data.

- User Authentication: Banks implement strong user authentication processes.

- Continuous Monitoring: Transactions are continuously monitored for suspicious activities.

Stay Secure

Keep your banking information private. Be cautious when sharing your code.

It Codes for International Money Transfer with Western Union

Western Union is a popular choice for international money transfers. Here’s how SWIFT/BIC codes fit into the process:

- Identify Banks: Western Union uses codes to identify the recipient’s bank.

- Speed: Using these codes speeds up the transfer process.

- Global Reach: With codes, Western Union can facilitate transactions worldwide.

Simple Process

To send money via Western Union, you’ll need the recipient’s code. This ensures the funds go directly to their bank.

Conclusion

It’s vital to know SWIFT and BIC codes for international money transfers. These codes ensure your funds reach the right place, quickly and securely. Verify the codes. Understand their importance. Follow the security measures. By doing so, you’ll navigate the world of international finance with confidence.